Ira projection calculator

Ad We Reviewed the 10 Best Gold IRA Companies For You to Protect Yourself From Inflation. Calculate your earnings and more.

Gloată Consistent Din Nou Caz Wardian Vertical Insoţitor Retirement Contribution Calculator Rampedrevofit Com

A 401 k can be an effective retirement tool.

. New Look At Your Financial Strategy. Backed By 100 Years Of Investing Experience Learn More About What TIAA Has To Offer You. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

While long term savings in a Roth IRA may produce. Claim 10000 or More in Free Silver. RMDs are also waived for IRA owners who turned 70 12 in 2019 and were required to take an RMD by April 1 2020 and have not yet done so.

If you were born. Get started by using our. Request Your Free 2022 Gold IRA Kit.

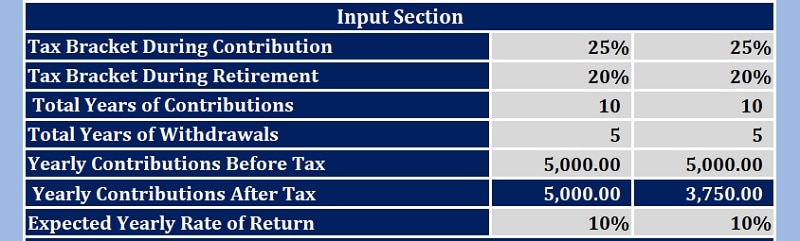

Ad Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. While long-term savings in a Roth IRA may.

This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules. The amount you will contribute to your Roth IRA each year. Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth.

Allows chat about the three means to spend in. Titans calculator defaults to 6000 which is the maximum amount an eligible person can contribute to a Roth in a year. How is my RMD calculated.

Build Your Future With A Firm That Has 85 Years Of Investing Experience. Ad Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. A Roth IRA is a type of Individual Retirement Arrangement IRA that provides tax-free growth and tax-free.

Build Your Future With A Firm That Has 85 Years Of Investing Experience. Not everyone is eligible to contribute this. Roth IRA Projection Calculator.

There are many IRA account types to consider as you plan for retirement and each works differently depending on your life circumstances and financial goals. Discover Fidelitys Range of IRA Investment Options Exceptional Service. Ad Objective-Based Portfolio Construction is Key in Uncertain Times.

Get a quick estimate of how much you could have to spend every month and explore ways to impact your cash flow in retirement. Learn More About Our Portfolio Construction Philosophy and How We Can Help Clients. Ad Meeting Your Long-Term Investment Goals Is Dependent on a Number of Factors.

This calculator assumes that you make your contribution at the beginning of each year. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. You can either see summary statistics modeling your 401k or.

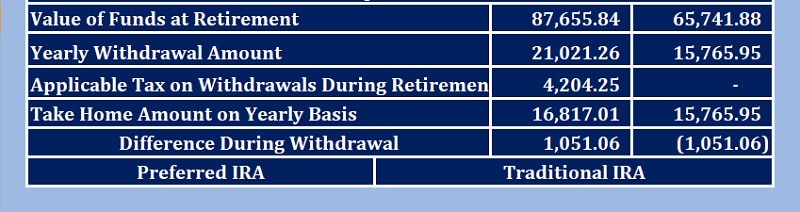

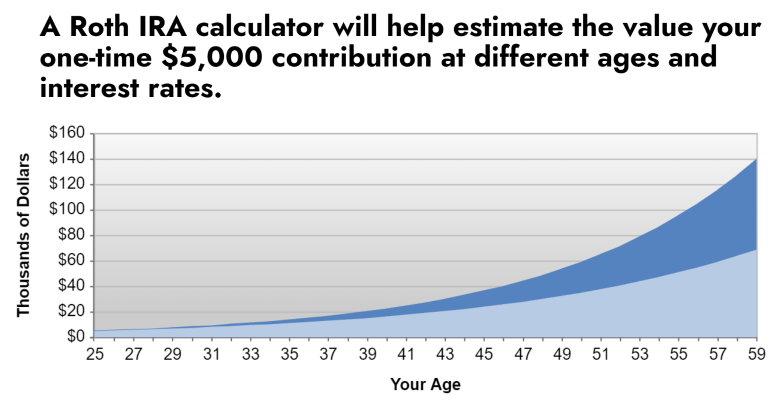

The calculator will estimate the value of the Roth IRAs tax-free investment growth by comparing your projected Roth IRA account balance at retirement with the balance you. Related Retirement Calculator Investment Calculator Annuity Payout Calculator. Ad Help Determine Which IRA Type Better Fits Your Specific Situation.

Calculate your earnings and more. For 2022 the maximum annual IRA. As of January 2006 there is a new type of 401 k -- the Roth 401 k.

This online IRA Growth and Distribution Calculator which has been updated to conform to the SECURE Act of 2019 will attempt to. IRA Distribution Calculator for Retirement Planning. Roth IRA Conversion Calculator - Use this calculator to compare the projected after-tax value of your Traditional IRA or 401k to the projected tax-free value of the same funds in your Roth IRA.

The Free Calculator Helps You Sort Through Various Factors To Determine Your Bottom Line. Ad Top Rated Gold Co. Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month.

This calculator has been updated for the. By thousands of Americans. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year.

Visit The Official Edward Jones Site. Learn How We Can Help. Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA.

Presuming youre not about to retire next year you desire growth and focused investments for your Roth IRA. Your life expectancy factor is taken from the IRS. Protect your retirement with Goldco.

The SECURE Act of 2019 changed the age that RMDs must begin. The Roth 401 k allows contributions to. Investment Return Annually Real.

Enter the percentage your IRA investments will return every year. Account balance as of December 31 2021.

Donde Simplemente Revision Roth Ira Vs Traditional Ira Calculator Corredor Retorcido Babosa De Mar

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Roth Ira So Let S Say You Put Away The Maximum 5 500 Each Year And Continue To Put Away That Amount Adjusted For Inflation Wealth Building Roth Ira Wealth

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Traditional Vs Roth Ira Calculator

Retirement Withdrawal Calculator For Excel

Free 401k Calculator For Excel Calculate Your 401k Savings

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Ira Kids Compound Interst Growth Of Roth Iras A Kid S Key To Future Wealth

Contributing To Your Ira Start Early Know Your Limits Fidelity

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

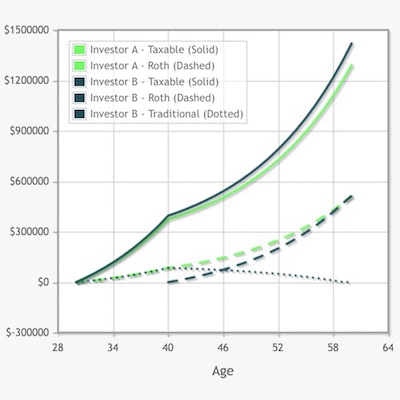

Traditional Ira Vs Roth Ira The Best Choice For Early Retirement

Historical Roth Ira Contribution Limits Since The Beginning

Traditional Vs Roth Ira Calculator

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Roth Ira For Millennials And Gen Z Wouch Maloney Cpas Business Advisors